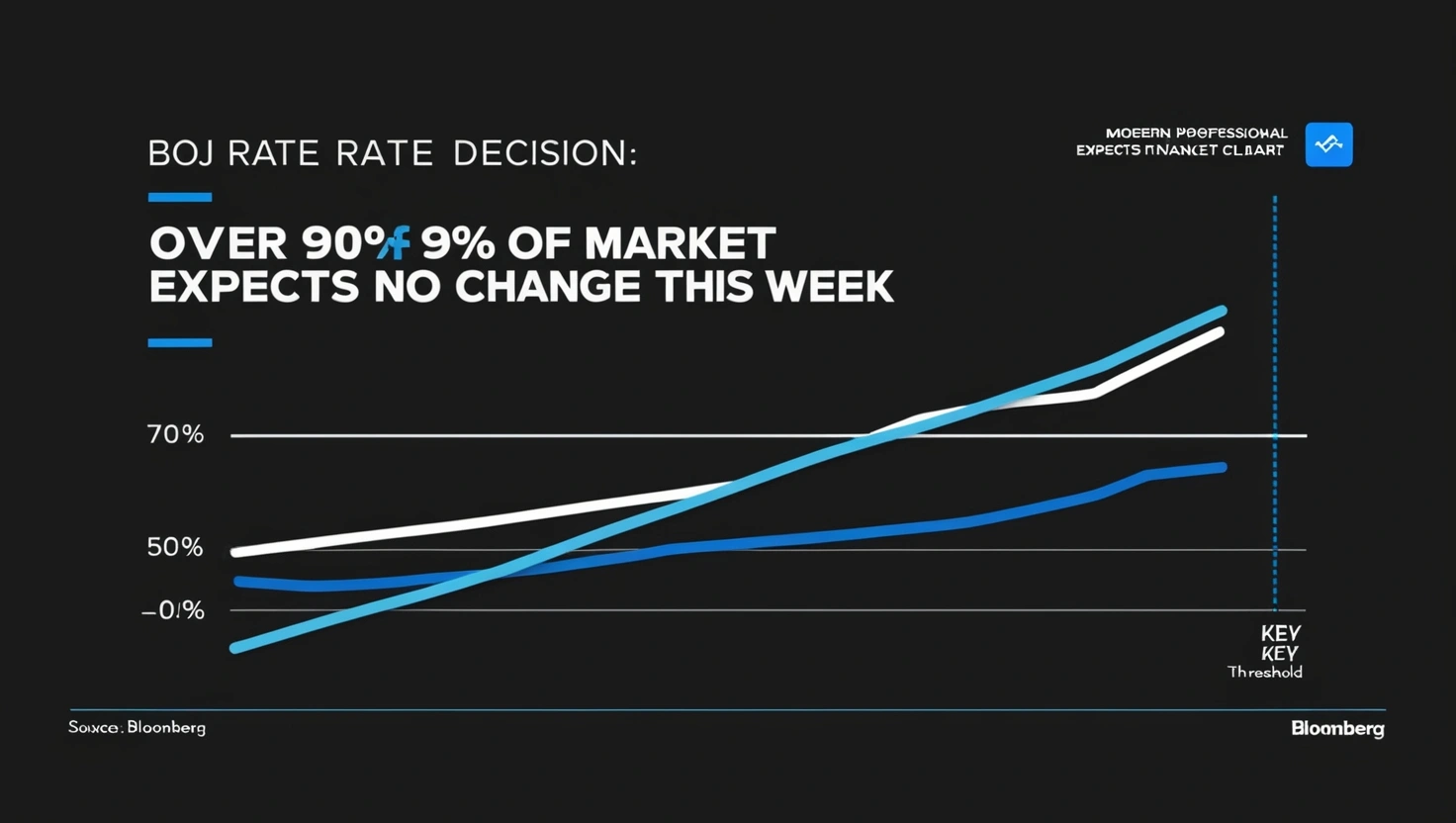

TOKYO (Reuters) – A recent survey conducted by money market brokerage Ueda Yagi Tanshi revealed that over 90% of market participants expect the Bank of Japan (BOJ) to maintain its current interest rates at this week’s policy meeting.

The survey, conducted between December 12 and 16, included responses from 150 financial institutions, such as banks, securities firms, and insurers, ahead of the BOJ’s two-day policy meeting concluding on Thursday.

According to the results, 91% of respondents believe the central bank will leave its short-term interest rate unchanged at 0.25% for now. However, expectations for a rate increase in the near future remain strong. Around 95% of those surveyed predict the overnight call rate, the BOJ’s key policy target, will rise within the next three months, a significant jump from 67% in the previous survey conducted in October.

The BOJ, which ended its negative interest rate policy in March and raised its short-term target to 0.25% in July, has taken a cautious stance on future hikes. Policymakers have emphasized that additional increases would depend on sustainable wage growth and inflation reaching the central bank’s 2% target.

While the BOJ has hinted at its willingness to raise rates further if economic conditions align with their projections, the exact timing remains uncertain. This ambiguity has left market expectations oscillating between December and January for a potential rate adjustment.