In the 2024 budget, the Canadian government has taken notable strides to address the challenges faced by the nation’s media sector. By revising and enhancing the Canadian Journalism Labour Tax Credit (CJLTC), the new measures aim to foster a more sustainable and equitable environment for journalists and media enterprises. These changes highlight the government’s recognition of the vital role journalism plays in maintaining a vibrant and inclusive media landscape.

What Is the Canadian Journalism Labour Tax Credit?

The Canadian Journalism Labour Tax Credit is a refundable tax credit designed to support labour costs associated with producing original news content. This initiative, introduced by the Canadian government, reflects a strong commitment to bolstering a dynamic media ecosystem that represents diverse perspectives. By providing financial relief to eligible news organizations, the CJLTC seeks to alleviate the financial pressures media enterprises face in today’s rapidly evolving digital landscape.

Key Updates for 2024

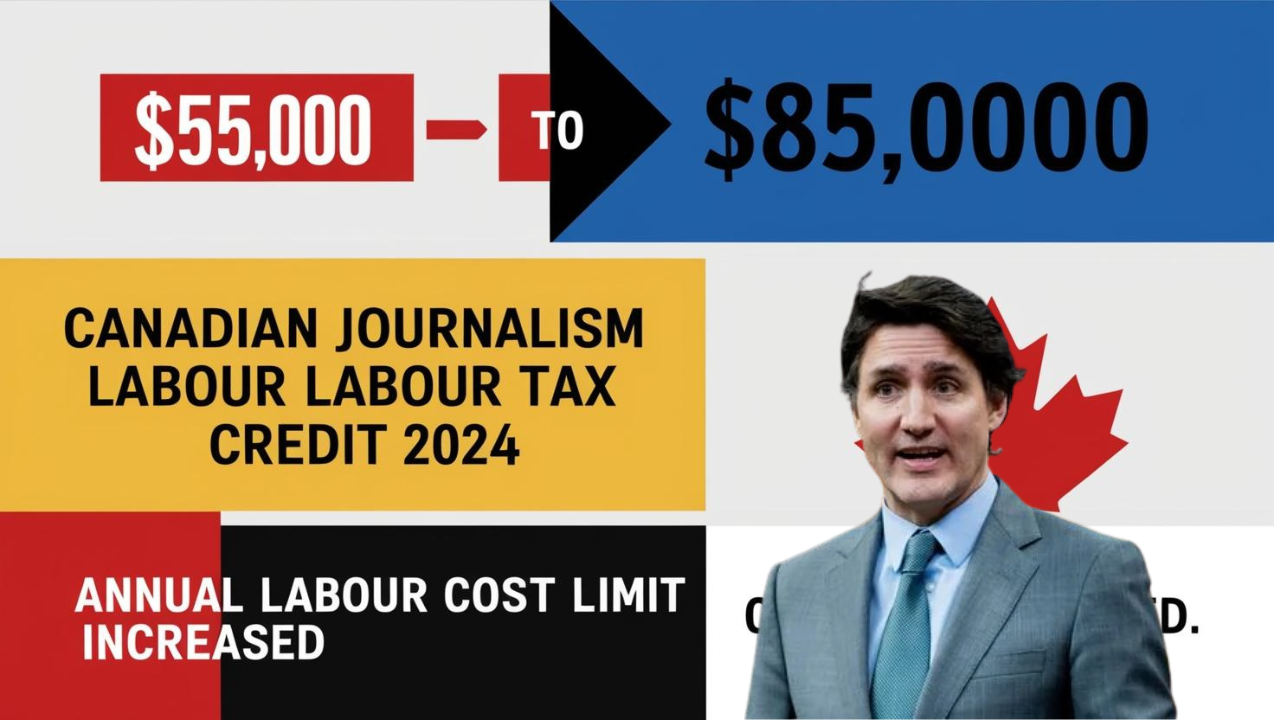

- Increased Annual Labour Cost LimitThe most significant update to the CJLTC in 2024 is the increase in the annual labour cost cap per employee. This limit has risen from $55,000 to $85,000, reflecting current economic realities and the rising costs associated with journalism. This adjustment provides greater fiscal support to media organizations and journalists, enabling them to better manage operational expenses.

- Expanded Eligibility CriteriaThe revised eligibility criteria now encompass a broader range of roles within the media sector. Journalists, reporters, and other professionals engaged in diverse activities are now included, fostering a more comprehensive and multifaceted approach to news creation and dissemination. This change is expected to strengthen the journalism industry by integrating innovative strategies suited to the modern technological era.

- Focus on Digital InnovationRecognizing the growing importance of digital media, the CJLTC emphasizes investments in digital advancements. Qualified enterprises are encouraged to adopt tools and technologies that enhance content creation, distribution, and analysis. This focus aims to empower media organizations to generate diverse and impactful news content while improving their outreach capabilities.

Benefits of the 2024 Amendments

- Economic Relief for Media EnterprisesRaising the annual labour cost limit to $85,000 per employee provides much-needed financial relief to media organizations. This amendment helps offset operational costs, allowing resources to be allocated more effectively and promoting overall stability within the sector.

- Increased Job OpportunitiesBy enhancing fiscal support, the CJLTC encourages media enterprises to expand their workforce. This creates new opportunities for journalists and other media professionals, contributing to industry growth and stability while addressing employment challenges.

- Support for Local JournalismLocal and community journalism plays a crucial role in ensuring diverse voices and perspectives are heard. The expanded support offered by the CJLTC reinforces the capabilities of smaller media organizations, enabling them to thrive and continue serving their communities effectively.

Outlook and Future Impact

The 2024 revisions to the CJLTC are poised to create a more resilient and innovative media industry in Canada. By providing enhanced financial support and encouraging digital transformation, these changes underscore the government’s dedication to fostering a free and independent press—an essential pillar of democracy. The amendments not only address the current economic challenges but also pave the way for a sustainable and inclusive future for Canadian journalism.