If you were affected by the DP Brokerage Data Breach, you may be wondering about your eligibility for compensation, how to track your claim status, and when to expect a payment. This guide offers a straightforward look at the settlement process, from confirming eligibility to checking payment status and understanding what factors determine your compensation amount.

Key Takeaways:

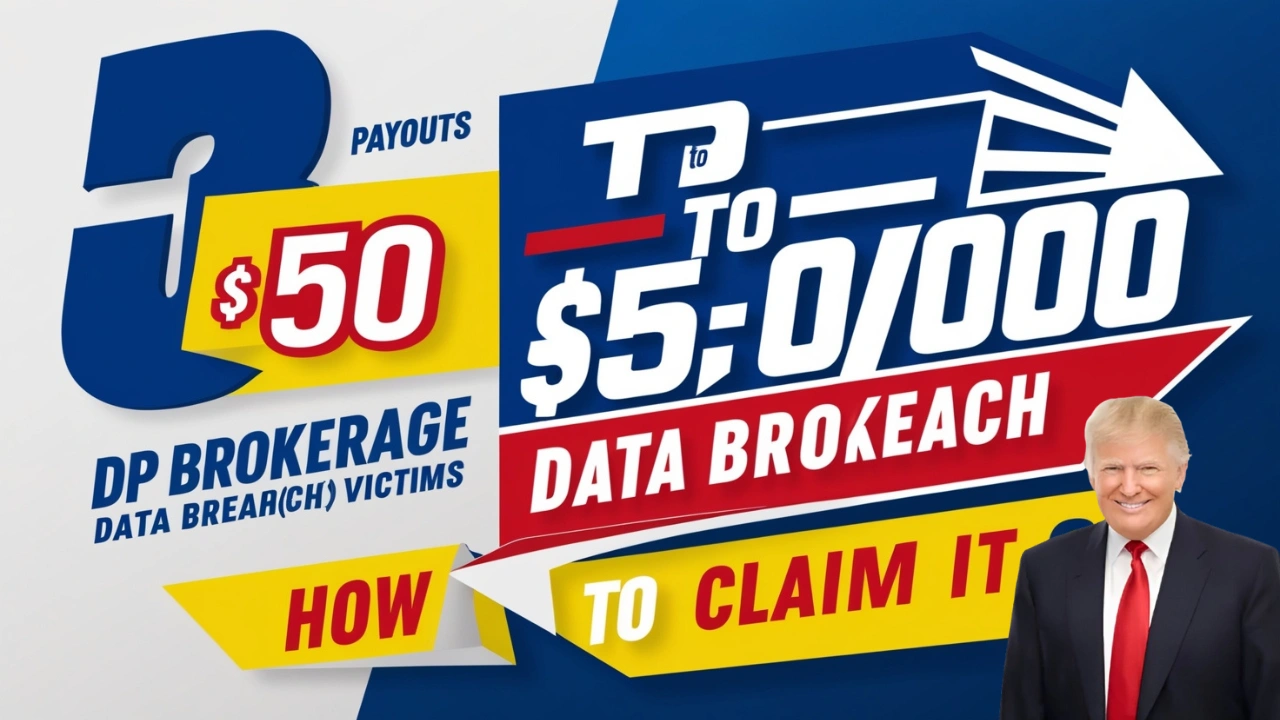

- Settlement Amounts: Payments range from $50 to $5,000 depending on the type of claim and the extent of damages.

- Eligibility: Those whose personal information was compromised or who experienced financial losses may be eligible.

- Claims Process: Claims can be submitted online or via mail by the specified deadline.

- Payment Timeline: Payments are generally issued a few months after the claims deadline, with timing depending on the claim volume and approval process.

Navigating the DP Brokerage Data Breach Settlement can be daunting, but understanding the claims process step-by-step can simplify it. Here’s everything you need to know to ensure you receive the compensation you’re owed.

What is the DP Brokerage Data Breach?

A data breach happens when sensitive personal or financial information is exposed, often due to hacking or mishandling. In the case of the DP Brokerage Data Breach, personal information—such as social security numbers, addresses, and bank details—was compromised. If your data was involved, you could be eligible for compensation through this settlement.

The damages caused by a data breach are serious, including identity theft, financial losses, and emotional distress. Data breaches are especially concerning for brokerage firms, which store highly sensitive financial data. If you were affected, this settlement provides a chance to recover losses.

Types of Damages from Data Breaches

- Identity Theft: Cybercriminals might use stolen data to commit fraud or open unauthorized accounts in your name.

- Financial Loss: Unauthorized transactions, loan applications, or withdrawals are common after breaches.

- Credit Score Damage: Fraudulent activities that go unnoticed can harm your credit score.

Given these risks, settlements like the DP Brokerage Data Breach offer a vital opportunity to mitigate the impact of such breaches. But to get compensation, you need to file a claim correctly and track its status.

The Claims Process: A Step-by-Step Guide

Follow these simple steps to ensure your claim is submitted successfully.

Step 1: Confirm Your Eligibility

Check if you qualify for the settlement. You might be eligible if:

- Your personal or financial information was exposed during the breach.

- You experienced financial harm such as fraudulent charges or identity theft.

Visit the official DP Brokerage Data Breach Settlement website to confirm your eligibility. Be sure to read the criteria carefully, as some individuals may not qualify based on the specifics of the breach.

Step 2: Submit Your Claim

Once you’re eligible, you can file your claim either online or by mail. When filing online, you’ll be asked to provide:

- Personal information (e.g., name, address)

- Details of how you were affected (e.g., fraud or identity theft)

- Proof of damages, such as bank statements or fraud reports

Make sure to submit your claim before the deadline. Late submissions are usually not accepted, so aim to submit it well in advance. The official website will have a calendar or a section listing important deadlines.

Step 3: Wait for Processing

After submission, your claim will be reviewed by the Claims Administrator. This review process may take several weeks or months, depending on how many claims are submitted.

During this time, you may be asked for additional information. Make sure to respond quickly to any requests for further documentation to avoid delays.